|

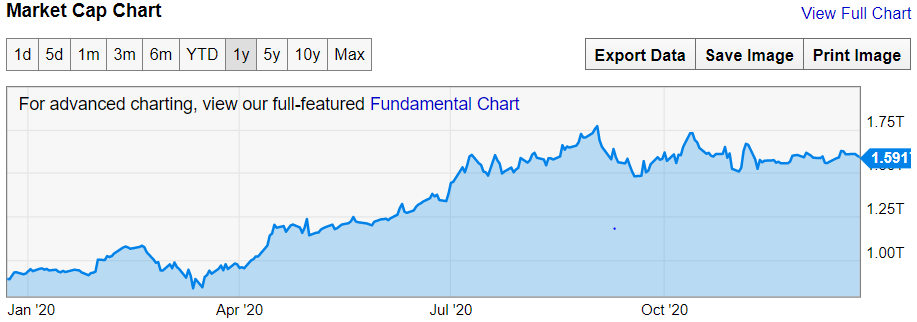

I'm not a big fan of taxes, but after the latest (now vetoed) stimulus bill that would borrow/print another $900 billion and give Americans a whopping $600 one-time "stimulus," it would seem that a one-time Covid tax is called for. Many Americans are struggling and something like 400,000 small businesses have closed with many more at risk of failing. At the same time, the national debt is 20 trillion and our deficit this year will be more than twice what we bring in. Yet, many giant firms have had record years with Amazon, Facebook, Microsoft, Apple and Netflix are all up 20 to 60% YTD.  I think the lockdowns were overkill, but whatever you think about them, it's undeniable that the government enacted them and the winners were big business (and the government itself of course) and the losers were basically everyone else. A one-time Covid tax on those winners with subsidies to struggling small businesses and working class and middle class Americans on the edge as well as, I don't know, maybe a little bit for the deficit would seem be in order. Yes I know the rich pay the large majority of income taxes (the top 1 percent pays 39 percent). Although they pay much less so with sales taxes, payroll taxes and property taxes. But what I posted was about corporations and what would amount to a corporate tax. For example, Amazon's market cap went from $890 billion to $1.6 trillion this year. The large majority of that almost doubling was because of the lockdowns. See the lockdowns as a form of indirect but massive corporate welfare. I recommend clawing some of that back.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed