|

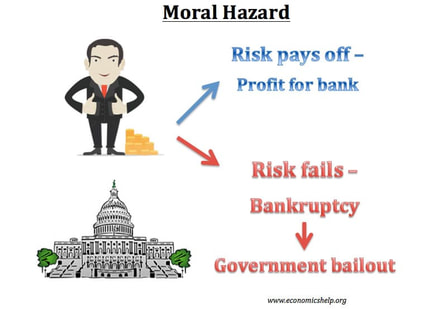

So Congress passed a $2 trillion stimulus package and it's packed full of corporate goodies. According to Reason Magazine, The final stimulus ballooned in cost over a week of negotiations as both sides sought to insert additional funding for their desired provisions. In the first three stimulus drafts, the corporate loan guarantees—which the federal government must recoup if businesses aren't able to repay their debts—amounted to $208 billion. In the final version, that number had grown to $500 billion. Remember, much of what Boeing did in the last few years was use their capital reserves to buy back stocks for a short term gain. This left them with insufficient liquidity to survive a Black Swan event like what we're currently living through. But the bigger problem to consider was; was this even a bad decision on their part? As the 2008 Financial Crisis showed, big companies get bailed out by the government when they're reckless. So why not make short term, risky plays to make the quarterly financial report look better when you know that if things go wrong, you can always get Daddy Government to pick up the check. This is a textbook case of moral hazard, as defined by Wikipedia, In economics, moral hazard occurs when an actor has an incentive to increase their exposure to risk because they do not bear the full costs of that risk. For example, when a person is insured, they may take on higher risk knowing that their insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. If such bailouts are necessary (which may be true this time, but usually isn't) they should be extremely painful. They should at least require all executives give up their bonuses and probably forfeit their annual salaries. In addition, the loans shouldn't be cheap.

Perhaps the interest rate should be low to start with, but like the teaser rate mortgages from before the 2008 Financial Crisis. The loans (or loan guarantees) should also have a sort of-yield maintenance. This is a common instrument in commercial real estate where if a borrower prepays a loan before the term is up, the borrower has to also pay the remaining amount of interest due for the duration of the term. In other words, the loans should be expensive and the government should make a sizeable profit from such loans and loan guarantees. Making such bailouts painful would make executives think twice about making risky, short term plays and using up their cash reserves to increase quarterly profits. As odious as corporate bailouts and corporate welfare are, this is the least we can do.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed