|

One of my favorite articles I wrote for Swifteconomics on the nonsense that is gurus (and particularly real estate investment gurus): In the real world I work in real estate investment (yes, it’s been an interesting ride over the past couple years). Like just about every other industry, it’s important to educate yourself about the field. Unfortunately, while there is a lot of good information out there, there’s also a lot of garbage, especially in real estate. I’m quickly reminded of that episode of The Simpson’s where some salesman is offering his book How to Get People to Pay You $50 for a Book for a mere $50. There certainly are an awful lot of get-rich-quick schemes and gurus in the real estate field. I have, unfortunately, attended several of their seminars. Some, such as David Lindahl, I’ve gained significantly from. Others, well, not so much. I won’t name names, but one who was particularly worthless, we’ll call him Wuss Rhitney, may shine some light on how this works: First are the TV commercials saying “Free day long seminar on how to get rich flipping real estate.” Fantastic. Well business was pretty slow at the time, so we decided to go and see if there was a kernel of wisdom in it. Of course there wasn’t, it was a day long sales pitch for a three day event. Still that only cost $100. We figured it would be a great place to network with potential investors so we decided to suck it up and pay the $100. Needless to say, we left after lunch on the first day. Had this seminar gone the way of most—even the good ones—it would have ended with the closing sales pitch. These are always the same. The speaker will announce their product, one piece at a time; first the bootcamp, then CD’s and workbook, then the free mentoring, then the newsletter, etc. Then they will throw out a high and completely arbitrary price, which is obviously “what it usually sells for.” At this point they’ll mention that there are only a limited number of products available. A few uniformed souls (or possibly plants) will jump out of their seat and power walk to the back counter to buy immediately. Then the guru will continue telling you how good the product is, how financially free they are, how much they love spending time with their family, which of course they would be doing if they didn’t have this dying desire to spread the incredible knowledge they have among the masses and so forth. During this time members of the audience are trying to justify the purchase. But oh wait, they have one final price drop for you now bringing the price to only 20% of the real market value (read: arbitrarily selected opening price). Now those who were trying to justify buying at the higher price have their minds made up for them. The tactic certainly works. It works for the good ones and the bad ones. And the bad ones, are typically a bit sue-happy. This was the case with Wuss Rhitney, who went after the “anti-guru” John T. Reed for posting a negative review of his work. John T. Reed responded by launching an all out investigation against him and found, among other things: – Wuss Rhitney claimed to own millions of dollars of real estate by 25, when in fact he owned only $98,000 worth of heavily leveraged property at that time (maybe he meant millions of yen) Wuss Rhitney is an extreme case though. Many are just shysters. On Reed’s website he has “guru rankings” and a “Real Estate B.S. Detection Checklist.” Some of the items, which I think can be easily adjusted for gurus in just about every field, include – Emphasis on luxurious lifestyle As John T. Reed notes, “In general the gurus I do not recommend are salesmen, not real estate guys. Both carnival barkers and the majority of real-estate gurus are salesmen.” Many, not surprisingly, have sales backgrounds as well. It’s not just real estate. I got suckered into an Amway Global seminar once. The first 50 minutes of the seminar, which I’m embarrassed I stayed for, was basically a rehash of Robert Kiyosaki’s The Cashflow Quadrant (which can be boiled down to this; owning company = good, working for company = bad). During this time they surprisingly didn’t mention the company’s name nor what you’d actually be doing if you signed up with them. When he finally did drop the Amway bomb, you could hear a collective sigh. I discreetly made my way out of the room.

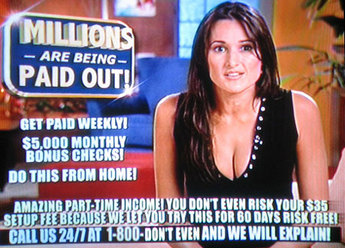

And then add informercials, which are little more than televised guru seminars. Or how about the Internet, which has created a haven for gurus that don’t even need to have seminars or long, late night TV spots. One website promises to show you “how to create a lifestyle most people only dream about living” through some online business venture. You have to give them you’re email address to find out the price though. Another site offers to teach you how to lose 10 pounds in two weeks. Cost: $14.99 (half of the regular, arbitrary price that is never charged). Another offers to teach you how to “make girls wet with your eyes.” Cost: $57 (again half the “real” price). And all those seem cheap. I remember some guy trying to get me into a business selling other people’s stuff on eBay. All I had to put down was $3,000. That sounds pretty reasonable I think. Now, some of this stuff is obviously complete garbage, but some of these things do work… at least for a few people (see Timothy Ferrisfor one). The problem is you don’t make a lot of money by targeting the select few who actually can benefit from it. The shotgun approach is what makes money. Thus these strategies have to be “easy.” On the other side of things, I don’t need a bunch of reviews to tell me P90X works. It’s a brutal 90 day workout, of course it works. The question is, can you stay with it. But P90X makes it clear its routine is going to be vicious and actually makes that part of the sales pitch (which I commend them on). Unfortunately, with get-rich-quick, become-a-beauty-model-overnight and create-a-harem-for-yourself pitches, it makes sense financially for the guru to market them to a wide group of people as if doing it was easy. Thereby, even at good seminars there are usually a lot more people there then should be. Most won’t start or will quickly get discouraged. Some will become disillusioned and angry at the guru, others will blame themselves, but probably most will move on to the next shiny object that gets their attention. And that’s the game. So be careful you know what you’re getting into before you sign up. Don’t go to a seminar unless you are somewhat acquainted with the topic at hand. For example, if you’ve never invested in real estate, pick up a book or two before going to a seminar. Read online reviews about the seminar, guru, program or whatever it is. Be very weary of any up-selling at the events or guest speakers with something to sell (you can always wait a day and buy it after you’ve had time to think about it, no matter what they say…always). And know that virtually all good things require effort and are by no means a sure bet. As good as a guru can make a deal sound, it always has some sort of downside. Photo Credit: Business Networking U and Vacant Desk _____________________________________________________________ *Mortgage holders pay mostly interest at first then as the loan nears maturity, their payments become more and more principle. This is why a 30 year loan that is 20 years old will only be about half way paid off instead of two thirds.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed