|

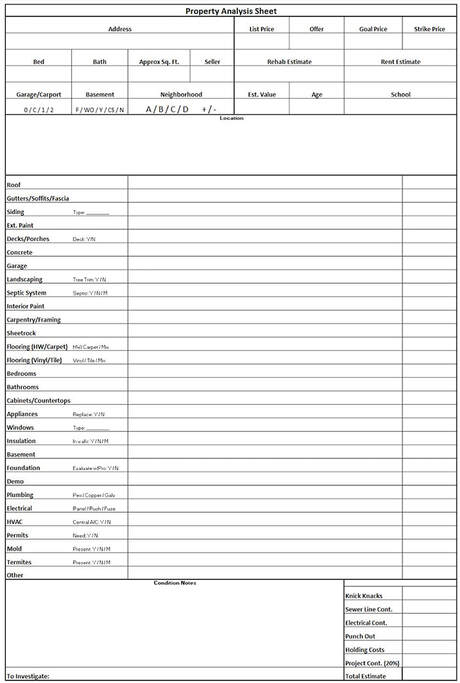

If there's one thing I repeat over and over again to new real estate investors, it's that rehab will always take more time and cost more money than they think it will. This common error even has a name; the optimism bias. One example from Thinking Fast and Slow by Daniel Kahnemann is quite illustrative; A survey of American homeowners who had remodeled their kitchens found that the average person expected to spend a bit over $18,000, but ended up paying over $38,000! My favorite (least favorite?) example is the Sydney Opera House, which was originally estimated to cost $7 million and came in at just over $100 million and a full 10 years behind schedule! I have never heard a single real estate investor, contractor or developer complain about "budgeting too much" for rehabs. Yes, it does happen. We've come in under budget plenty of times. But it's much more common to go over budget, especially in the early going. And I've seen investors go over budget by 100 percent or 200 percent or even more. I have never seen someone come in wildly under-budget on a consistent basis. The errors for budgeting are not normally distributed as you would see on a bell curve. Instead, these errors are slanted heavily toward the error of budgeting too little. So the more you can do to learn how to estimate rehab costs the better. And the best place to start is The Book on Estimating Rehab Costs by J. Scott. The book is, of course, no panacea. As Scott himself says, “Learning how to put together a realistic SOW [Scope of Work] and create an accurate budget takes preparation, practice and experience -- there are no shortcuts.” (Pg. 9) Instead, the "book will provide a framework for thinking about the tasks associated with renovation projects and the range of costs associated with each of those tasks." (Pg. 8) Scott breaks a property down into 25 key components. I actually took that list and used it build my 1-page analysis sheet I fill out when looking at a property for the first time. (I added a couple of categories; splitting flooring into two and separating the foundation and the basement.) Here is my sheet based on Scott's book: For anyone who's interested, I would be happy to send the Excel document of this.

Far too many investors go into a project and wing the scope of work (or don't even make one) instead of having a template prepared to fill out. Just like an injection mold makes it far easier to mass produce widgets, having a template with which to create a scope of work makes putting together a scope of work much easier and more accurate. This is why a book like Scott's is so helpful. Scott works his way through each major component of the house (i.e. plumbing, electrical, framing, HVAC, etc.) and discusses what to look for, the common items that need to be done and the typical costs of those items. It's an especially handy guide to new investors, but useful to more seasoned investors as well. Obviously the prices in the original are outdated, but a second edition was released in 2019 and is more or less current with today's market. If you plan on rehabbing houses, I highly recommend getting a copy of this book! For those interested, you can find it here. Also see my review of Matt Faircloth's Raising Private Capital here.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed