|

And here is the follow up to my article on market alternatives to global warming from SwiftEconomics.com. This time, I discuss all the corporate welfare and cronyism going on with the new "global warming industry." No matter how big a threat you believe global warming is, this type of cronyism should concern you.

“It’s hard to get a man to understand something when his job depends on him not understanding it.” (1)

Those are the words of Al Gore, quoting Upton Sinclair, in his Academy Award/Nobel Prize winning documentary An Inconvenient Truth. It’s the good ol’ follow-the-money line. It presupposes that American corporations oppose any measure to cap carbon emissions because it will hurt their profits. And this makes sense: if we move away from oil, oil companies will be devastated. Thus, we must push through a carbon trading scheme to offset emissions, even if, no, because corporations oppose it. Paul Krugman went so far as to call anyone who opposed such a bill a “traitor to the planet.” (2) This same sentiment is best articulated by the most liberal member of congress, Dennis Kucinich

“[H.R. 2454, the cap-and-trade bill] is regressive. Free allocations doled out with the intent of blunting the effects on those of modest means will pale in comparison to the allocations that go to polluters and special interests. The financial benefits of offsets and unlimited banking also tend to accrue to large corporations. And of course, the trillion dollar carbon derivatives market will help Wall Street investors. Much of the benefits designed to assist consumers are passed through coal companies and other large corporations, on whom we will rely to pass on the savings.” (3)

Wait a minute Dennis, carbon trading is a regressive tax to benefit the rich, well-connected corporations? Nonsense! Or perhaps, we should go ahead and take Al Gore’s advice and follow the money. And perhaps, we should start with Al Gore’s own words, taken from the bonus material on the DVD release of An Inconvenient Truth:

“A lot of business leaders are changing their positions. New businesses and CEO’s and corporations every week are now joining this new bandwagon saying ‘we want to be part of the solution and not part of the problem.’” (4)

Where did Al Gore’s skepticism go? I thought businessmen just wanted to pad their bottom line; now they want to save the planet? If we follow the money, we can see that there’s a lot of money in “being green.” Just the image of being green helps a company’s brand name, as IBM seems to have taken note of:

Saving millions on energy costs is one of those win/win things they talk about in business school so often; unfortunately, it goes deeper than that. Dennis Kucinich is right. The carbon trading scheme that passed the House and is making its way to the Senate is a new derivatives market set up at the behest of Goldman Sachs and other major Wall Street financial firms. Out of curiosity, how did the last financial derivatives market turn out? And yes, it is also a regressive tax, (Who do you think is hurt most by higher energy bills?).

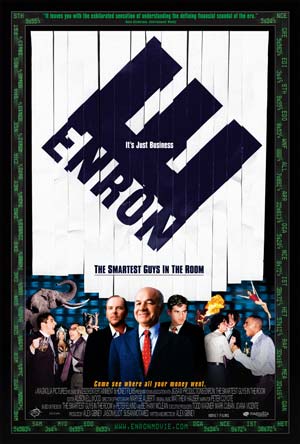

While it’s true that major energy companies are not fond of having to cap their emissions, financial firms can only gain by having a new market to trade in. What people miss when looking at the corruption caused by corporations and government being in bed together is that different corporations have different goals. Many companies may oppose government health care, but companies such as GM and Ford, who are drowning in health care costs, could benefit significantly from government-run health care. Google supports net neutrality, AT&T opposes it. And on and on it goes. So who stands to benefit from cap and trade? Well, Goldman Sachs for one. In January of 2009, Goldman Sachs bought Constellation Energy’s carbon trading operation. (5) Maybe, just maybe, they see a potential market to exploit. Even Al Gore himself is getting in on the take. Al Gore is an owner of the venture capital company Kleiner Perkins Caufield & Byers. His company backed a small start-up firm named Silver Spring Networks, which produces equipment to make electricity grids more efficient. In October of 2009, the U.S. Department of Energy gave out $3.4 billion of “smart grid” grants; $560 million went to utilities with which Silver Spring has contracts. (6) The Telegraph predicts that “Al Gore could become the world’s first carbon billionaire.” (7) Maybe that’s where Al Gore’s skepticism went: right to the bank. This may seem outrageous, but that whole mess of corruption pales in comparison to the company that helped draft the initial concept for a carbon trading system: everyone’s favorite, now-defunct, energy trading firm, Enron. In 1997, then Enron CEO, Ken Lay wrote an op-ed entitled “For Prevention’s Sake: Focus on Climate Solutions.” In it he strongly advocated the Kyoto Protocol, which would cap carbon emissions worldwide. On August 4th, 1997, Ken Lay met with Bill Clinton, Al Gore and others at the White House to discuss Kyoto. Ken Lay was an enthusiastic supporter. This may seem odd to some because George Bush was a close friend of Ken Lay, but Bush refused to sign the Kyoto Protocol. Apparently, George Bush either had other special interest groups to appease, or he simply disagreed with his friend (almost certainly the former). Ken Lay never gave up, though. In 2001, Lay sent an emissary to the Bush administration to lobby for Kyoto. Why would Enron support cap and trade? The answer is the same as the answer for Goldman Sachs: it created a new energy market for them to trade in. Enron went bankrupt soon afterwards however, before it could influence any more politicians. (8) But even though Enron is now gone, its baby lives on. Investigative Magazine, a New Zealand journal, concluded that “…without Enron there would have been no Kyoto Protocol.” (9) This may be a bit hyperbolic, but Enron did help establish and trade extensively in the $20 billion-per-year sulphur dioxide cap and trade scheme the EPA set up to deal with acid rain. Enron’s link to carbon trading is simply undeniable. Furthermore, making money off of global warming solutions extends beyond trading carbon credits. Archer Daniels Midlands, the company TJ Rodgers, CEO of Cypress Semiconductors Corporation, calls “the pork barrel champion of all time,” (10) has made a fortune off of corn ethanol subsidies. Regardless of whether corn ethanol reduces carbon emissions (it doesn’t), it should be quite telling that Archer Daniels Midlands has received billions of dollars from the federal government to grow corn, (and you thought farm subsidies went to poor farmers and not big corporations). Does the president of ADM care whether corn ethanol is effective? Perhaps, but he certainly cares that it is effective in padding the bottom line. Archer Daniels Midlands has consistently donated to both parties and received massive direct subsidies as well as sweetheart regulations. Dan Carney, writer for the liberal Mother Jones magazine, states “no other U.S. company is so reliant on politicians and governments to butter its bread.” (11) ADM benefits in three ways. First are direct subsidies, which are notably the least important. The second is an enormous tariff on sugar, (at the behest of both ADM and the Fanjul family’s sugar dynasty, which has also donated consistently to both parties) (12). This makes sugar more expensive in the United States and thereby increases the demand for corn ethanol. The final relates to corn ethanol, which Dan Carney describes as follows: “The third subsidy that ADM depends on is the 54-cent-per-gallon tax credit the federal government allows to refiners of the corn-derived ethanol used in auto fuel. For this subsidy, the federal government pays $3.5 billion over five years. Since ADM makes 60 percent of all the ethanol in the country, the government is essentially contributing $2.1 billion to ADM’s bottom line.” (13)

And while it’s true that Mother Jones is very skeptical of corporations and the free market itself (not that ADM represents a free market) it’s worth noting that the libertarian Cato Institute agreed with them completely, calling Archer Daniel Midlands a “case study in corporate welfare.” (14)

It becomes quite obvious that there’s a lot of green to be made in being green. But since we’re following the money, why stop with just corporations? Two other institutions come immediately to mind as possible global warming benefactors: the government and universities. Government’s incentive should be obvious. If corporations all too often seek money without regards to the human cost, governments all too often seek power without regards to the human cost. An extremely short glance at the blood-soaked 20th century should be evidence enough of this. And the more of the economy that the government controls, taxes, or regulates the more power they have. European governments have gone so far as to ban the sale of incandescent light bulbs. (15) Universities are a little more complicated. It works like this: many academics are reliant on government grants to fund their research. Donald Miller, of the Science and Public Policy Institute describes how a system so reliant on government financing creates—what he refers to as—”scientific dogmas.” (16) Namely, once a “consensus” has been reached, funding dries up for any alternative theories. This is what I would refer to as the “anti-scientific method.” The scientific method involves proposing a theory and then watching as everyone and their brother attempts to obliterate said theory and make a fool out of you. If a theory can withstand the initial barrage, then it simultaneously becomes accepted while awaiting the next onslaught of skepticism. So what happens when scientific theory becomes “dogma” and scientists are reliant on government funding? It creates a major incentive for scientists to fall in line. And when that “dogma” involves a political hot-ticket, there’s major incentive to get in line for government grant money. The recently-released emails between leading climate scientists lend a lot of creditability to this argument. For example, look at this one from climatologist, Kevin Trenberth: “If you think that Saiers is in the greenhouse skeptics camp, then, if we can find documentary evidence of this, we could go through official AGU channels to get him ousted.” (17)

Basically, Trenberth is trying to oust a scientist from a professional organization for disagreeing with him. Dogma indeed. Other emails allude to manipulating data to fit with this “dogma.” Furthermore, we have to ask whether academics and scientists proposing solutions such as cap-and-trade (a system that would give the government more power) would be more likely to receive grant money and political attention than those proposing, say, deregulating nuclear power. It may sound a bit conspiratorial, but it’s a question worth asking.

Now none of this is to say that corporate-financed research is any less biased. It would seem that smoking isn’t bad for you if you trusted the tobacco companies’ research back in the day. It’s just to say that skepticism needs to be applied everywhere. And the money needs to be followed everywhere. And following the money leads to some interesting conclusions doesn’t it Mr. Vice President? As I illustrated in my previous article, there are plenty of other, better ways to deal with global warming than cap-and-trade, assuming it’s worth dealing with at all. Unfortunately, those methods don’t enrich the special interests. So understandably, albeit shamefully, those methods are ignored. _______________________________________________________________________________________________________________ Previous: The Market and Global Warming: Alternatives to Cap and Trade _______________________________________________________________________________________________________________ (1) Al Gore, An Inconvenient Truth, Lawrence Benders Productions, 2006 (2) Paul Krugman, “Betraying the Planet,” The New York Times, June 26, 2009, http://www.nytimes.com/2009/06/29/opinion/29krugman.html?_r=1 (3) Dennis Kucinich, “Passing a weak bill today gives us weak environmental policy tomorrow,” Speech on House floor, June 26, 2009, http://kucinich.house.gov/News/DocumentSingle.aspx?DocumentID=134813 (4) Al Gore, An Inconvenient Truth, Lawrence Benders Productions, 2006, the bonus section can be seen at http://www.youtube.com/watch?v=TPem4XLr-Bc (5) “Update 1-Constellation to sell London unit to Goldman,” Reuters, January 20, 2009, http://uk.reuters.com/article/idUKN2031523720090120 (6) John M. Broder, “Gore’s Dual Role: Advocate and Investor,” The New York Times, November 2, 2009, http://www.nytimes.com/2009/11/03/business/energy-environment/03gore.html?_r=1&em (7) “Al Gore could become world’s first carbon billionaire,” The Telegraph, November 3, 2009, http://www.telegraph.co.uk/earth/energy/6491195/Al-Gore-could-become-worlds-first-carbon-billionaire.html (8) See Dan Morgan, “Enron Also Courted Democrats,” Washington Post, January 13, 2002, http://www.washingtonpost.com/ac2/wp-dyn/A37287-2002Jan12?language=printer and Timothy P. Carney, The Big Ripoff: How Big Business and Big Government Steal Your Money, Pg. 200-203, John Wiley & Sons Inc., Copyright 2006 (9) Thomas Lifson, “Enron, Kyoto, and trading pollution credits,” American Thinker, March 12, 2007, http://www.americanthinker.com/blog/2007/03/enron_kyoto_and_trading_pollut.html (10) T.J. Rodgers, “The Free-Market Case for Green,” Uncommon Knowledge, September 26, 2008, http://www.youtube.com/watch?v=jCjM2leF5F8 (11) Dan Carney, “Dwayne’s World,” Mother Jones, July/August 1995, http://www.motherjones.com/politics/1995/07/dwaynes-world (12) Timothy P. Carney, The Big Ripoff: How Big Business and Big Government Steal Your Money, Pg. 56-63, John Wiley & Sons Inc., Copyright 2006 (13) (11) Dan Carney, “Dwayne’s World,” Mother Jones, July/August 1995, http://www.motherjones.com/politics/1995/07/dwaynes-world (14) James Bovard, “Archer Daniels Midlands: A Case Study in Corporate Welfare,” September 26, 1995, http://www.cato.org/pubs/pas/pa-241.html (15) James Kanter, “Europe’s Ban on Old-Style Bulbs Begins,” The New York Times, August 31, 2009, http://www.nytimes.com/2009/09/01/business/energy-environment/01iht-bulb.html (16) Donald Miller, “The Trouble With Government Grants,” Science and Public Policy Institute, April 21, 2008, http://scienceandpublicpolicy.org/reprint/gov_grant_system_truth_or_innovation.html (17) See “ClimateGate – Climate center’s server hacked revealing documents and emails,” Examiner.com, November 20th, 2009, http://www.examiner.com/x-25061-Climate-Change-Examiner~y2009m11d20-ClimateGate–Climate-centers-server-hacked-revealing-documents-and-emails#update

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed