|

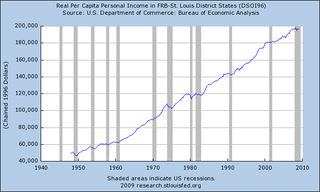

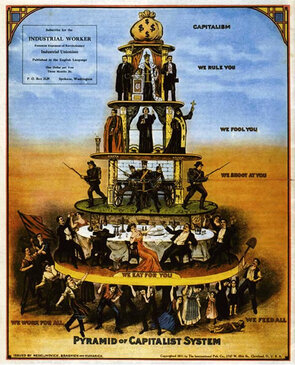

And here is the next article I wrote for SwiftEconomics on economic statistics and their misuse. (Also turned into a book, by the way.) Next in Lies, Damned Lies and Statistics Series: Part 3: All Fiat Currencies Fail Previous in Lies, Damned Lies and Statistics Series: Part 1: A Primer ___________________________________________________________________________________________________________________ “The system is rigged in favor of the few, and your name is not among them, not now and not ever. It’s rigged so well that it dupes many otherwise decent, sensible, hard-working people into believing that it works for them, too. It holds the carrot so close to their faces that they can smell it. And by promising that one day they will be able to eat the carrot, the system drafts an army of consumers and taxpayers who gladly, passionately, fight for the rights of the rich…” (1) The quote above is from Michael Moore’s cleverly titled book Dude Where’s My Country. The chapter entitled “Horatio Alger Must Die” (Horatio Alger wrote stories for working class people during the Gilded Age, with the morale that with hard work you can make it) highlights the common myth, in its extreme neo-Marxian form, supported by bogus statistics, that real income for the average American has stagnated since 1970 (or sometimes 1980 depending on who’s complaining). Certainly things have gotten bad with the recent recession, but was it really that bad all along for regular folks? Michael Moore would have you believe that incomes are stagnant and there is simply no way you’re going to move up. So get angry about it, maybe start a blog and type out said anger for all the world to see, but the most important thing you can do is give up. Unless, of course, you want to become a documentary film maker (or open a McDonald’s franchise next to said documentary film maker), who gets filthy rich explaining how it’s impossible to become filthy rich in this country, unless of course, you’ve been born into such filthy richness. The rich have certainly gotten richer, but that doesn’t necessarily mean they’ve gotten richer at other people’s expense. The pie can get bigger after all (if you somehow doubt that, compare living standards in the 19th century to now, or just look at the following graph). There are, however, statistics that show household income has basically stagnated, while the economy has expanded greatly. I guess Michael Moore, in all his enormous, vast, massive, gargantuan, colossal, earthquake-inducing wisdom, was right. Or perhaps, this statistic suffers from the “All Things Being Equal” fallacy; Correlation does not imply causation. As economist, Thomas Sowell, explains: “It is an undisputed fact that the average real income… of American households rose by only 6 percent from 1969 to 1996… But it is an equally undisputed fact that the average real income per person in the United States rose by 51% over that very same period. How can both these statistics be true? Because the average number of people per household was declining during those years.” (2)  Per Capita Income Chained to 1996 Dollars for St. Louis FRB States* Per Capita Income Chained to 1996 Dollars for St. Louis FRB States* The income increase rises further to 62%, when you include government subsidies. (3) The key lurking variable is household size, though. We cannot assume variables are unchanged over long periods of time. The percentage of households made of married couples dropped from 61.9% to 44.4% over those years. (4) As Thomas Sowell concludes, “The household thing is really a tip off. Whenever I see someone using household income, they’re trying to make things look bad.” (5) Even among single heads of households, men’s average income rose 12.6% and women’s average income rose 34.5% from 1969 to 1996. (6) This is despite the fact the average number of workers in a single headed household, whose income fell below the median, was only 0.286 in 1996 (0.757 for those above median). It’s very difficult for someone’s income to rise when they are not working. (7) In addition, as strange as it sounds, income is not always a great way to look at overall improvement in standard of living. Income statistics usually do not include transfer payments (such as social security or welfare), taxes or job benefits (401K’s, health insurance, etc.). They also often lump together part-time and full-time workers. Moreover, income statistics show people who graduate in the middle of the year, retirees, interns, wealthy business owners or investors having an off year and those between jobs, as poor. Honestly, of course college students are poor; it’s an investment in one’s future (at least they told me it was). Real consumption per person, on the other hand, increased 74% between 1980 and 2004, which, while affected by the increase in debt financing in the last 40 years, certainly indicates an improvement. (8) Furthermore, incomes are not only going up, there is flexibility between classes. A snapshot of income tells us little about whether a person, or group of people, is actually poor. I, after all, would be considered in the bottom 20% of incomes right now, despite having a college degree and having come from an affluent family. Again, from Thomas Sowell, “A study of income tax returns showed that more than four-fifths of the individuals in the bottom 20% of tax returns in 1979 were no longer there by 1988.” (9) Given that many in the bottom 20% are young or between jobs, this should not be surprising. OK, so the income stagnation myth and its corresponding statistics are shattered. But there’s one more argument left, which I’ll let Paul Krugman make: “There’s a big debate among economists over whether there’s been a convincing rise in the standard of living of the median family since the early 1970’s… the answer actually is not important… The amazing thing is we can even have that dispute. That it’s even in the range of argument. Think about the early 1970’s, no personal computers, no Internet, no personal faxes… we’re an enormously more productive, richer economy than we were in the 1970’s.” (10) This may be the most discombobulated argument I’ve ever heard. First, it relies simply on the fact that there is an argument about it to prove it must be a problem, a strange offshoot of the “Appeal to Authority” fallacy. There was also, for a long time, a major argument over whether or not bloodletting was a legitimate medical procedure. Obviously that must mean getting your bleed on after coming down with the swine flu has at least some validity, right? Something is either right or wrong, it doesn’t matter if there’s an argument about it.

In addition, many of the things he mentioned (Internet, phones, etc.) don’t show up in income data. Yes Paul, do think about the early 1970’s. Think of the things that didn’t exist in 1970, such as personal computers, the Internet, cell phones, GPS, DVD’s, hybrid cars, beta blockers, CT scans, Guitar Hero, etc. Or compare the houses and cars and phones and appliances and the like, from then and now. There has been a tangible rise in the standard of living not seen in incomes statistics simply because everything is better than it used to be. I mean, if nothing else, getting rid of shag carpets and plaid pants would show a “convincing” rise in the median family’s standard of living. Things have certainly gotten bad lately [circa 2009] and there’s been plenty of corporatism and way too much credit showered upon the middle and lower classes of society. However, this does not mean we’ve been creeping toward banana republic status for the last 30 to 40 years. I would hesitate to say that about the last two years with all the bailout mania (read corporatism). Still, long term income stagnation is nothing more than a statistical illusion. ___________________________________________________________________________________________________ Lies, Damned Lies and Statistics Series Part 1: A Primer Part 2: Income Stagnation Part 3: All Fiat Currencies Fail Part 4: Iraq War Casualties Part 5: Female-Male College Gap Part 6: Male-Female Wage Gap Part 7: Roger Maris’ Asterisk Part 8: Women Do All the Work but Men Keep All the Money Part 9: The BMI Part 10: A College Degree is Worth One Million Dollars ___________________________________________________________________________________________________ *St. Louis Federal Reserve District States include Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. (1) Michael Moore, Dude Where’s My Country, Pg. 145, Warner Books Inc., Copyright 2003 (2) Thomas Sowell, Economic Facts and Fallacies, Pg. 125, Basic Books, Copyright 2008 (3) U.S. Bureau of Census, “Changes in Median Household Income: 1969 to 1996,” Current Population Reports, P23-196, Pg. 1 (4) Ibid, Pg. 6 (5) Thomas Sowell, “Thomas Sowell – Is “Income Stagnation” an Economic Myth?,” Retrieved 8/16/09, http://www.youtube.com/watch?v=WrtoSx-NbLQ (6) U.S. Bureau of Census, “Changes in Median Household Income: 1969 to 1996,” Current Population Reports, P23-196, Pg. 7 (7) Ibid., Pg. 5 (8) Alan Reynolds, Income and Wealth, Pg. 57-59, Westport: Greenwood Press, Copyright 2006 (9) Thomas Sowell, The Vision of the Annointed, Pg. 44, Basic Books, Copyright 1995 (10) Paul Krugman, “Paul Krugman on Income Inequality,” Retrieved 8/16/09, http://www.youtube.com/watch?v=EBsB1VqTeSY

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed