|

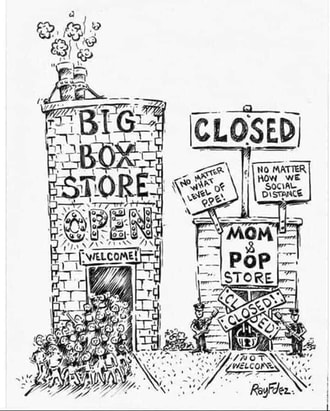

The Coronavirus and subsequent lockdowns decimated the US economy, sending unemployment spiraling to 14.7 percent, the highest its been since The Great Depression. Despite unprecedented government stimulus and bailouts (much of which found its way into the hands of giant corporations), many small businesses failed. Indeed, you can easily order something on Amazon during a lockdown. You can't go down to the locally owned store when it has been deemed "non-essential."

Entrepreneur Dan Price sums up this disaster as well as anyone could:

As The Street noted going into the Coronavirus lockdowns, small businesses were not prepared for this kind of shutdown,

According to a widely cited 2016 study by JP Morgan Chase, half of all small businesses have enough cash on hand to survive for only 27 days without new money coming in the door. The bar and restaurant industry tends to be particularly vulnerable. The average small service business has enough money on hand to survive just 19 days without any income.

Then there's this from a Chamber of Commerce survey at the beginning of April,

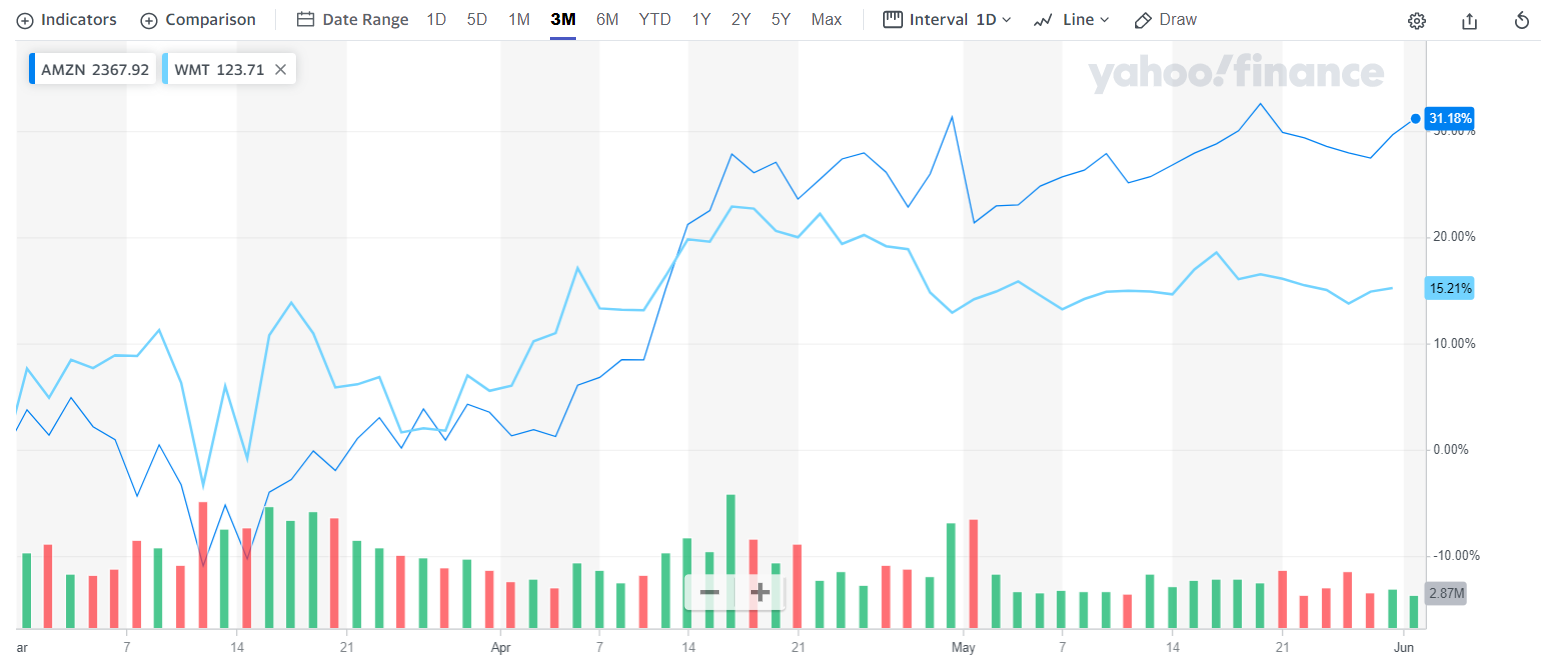

On the other hand, here's how Amazon and Wal-Mart performed over the last three months alone:

An annualized growth rate of 134% and 61% respectively. Not bad at all!

Then, on top of that, you have the recent protests-turned-riots over the last few weeks to exacerbate this issue. (And yes, George Floyd was murdered. I'm glad the cop who did it was arrested and he should go to prison for a very long time. But that's not the topic of this post.) Many of the stores and businesses that have been looted and burned were small businesses, most of which were probably already struggling from the Covid-19 lockdowns. Yes, an Autozone was burned down and a Target looted and CNN's headquarters were attacked. Many big companies were hit too, but they'll be fine. Insurance will cover their losses. And insurance will cover the losses of small businesses too... but only to a certain degree. Insurance policies have deductibles. Autozone can cover their deductible easily. Can Joe and Tracey's Antique Shop cover their's? In most cases, deductibles will be $5000 plus. Furthermore, looted shops will be unable to do business for some time. Insurance policies usually (but not always) cover such operating losses... but only for a certain amount of time. Will it be enough for all of them? And what if the areas these businesses are in lose a substantial amount of foot traffic for a long time afterwards? This is almost bound to happen and will hurt their sales even more. Small businesses are in really bad shape right now. The Internet and technology made it much easier to manage and operate huge firms and that, along with a wave of mergers, has lead to a general trend toward industry consolidation for quite some time leading up to 2020. The Coronavirus and subsequent lockdowns sent that trend into overdrive and the recent riots will only make things worse. This is something we need to be very vigilant about. No one should support a handful of super firms dominating the entire marketplace. Vibrant economies and successful countries have a strong small business sector. And we are in danger of losing ours.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

August 2018

Blog Roll

Bigger Pockets REI Club Tim Ferris Joe Rogan Adam Carolla MAREI Worcester Investments Entrepreneur The Righteous Mind Star Slate Codex Mises Institute Tom Woods Consulting by RPM Swift Economics Categories |

RSS Feed

RSS Feed