|

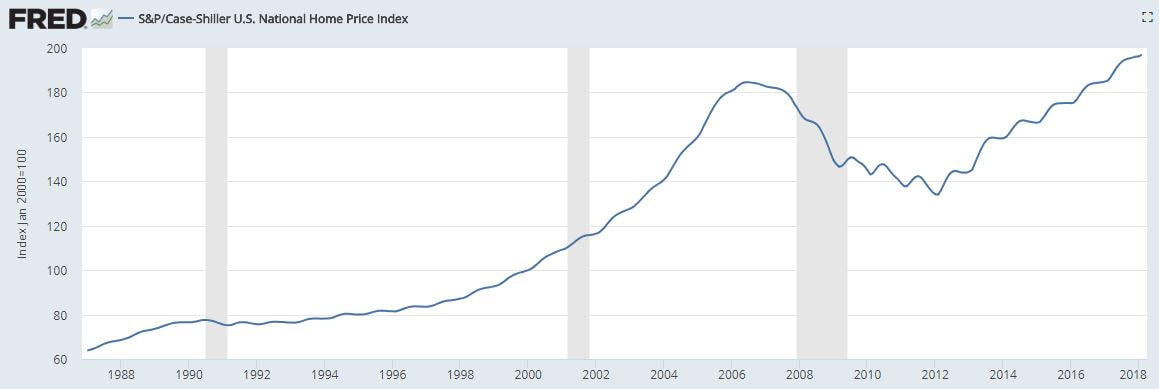

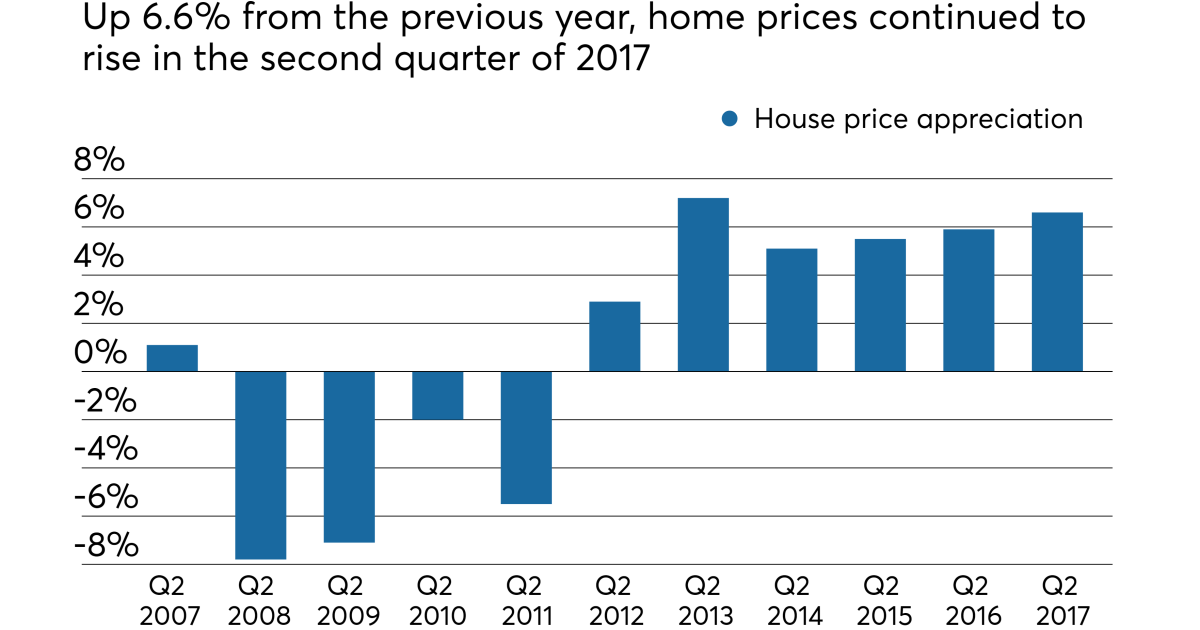

House prices are hot. Real hot in fact. Given that this is my industry, it's a pressing question as to how long this trend can continue. As Inman reports, "Home prices in February rose 6.7 percent year over year and inched up 1 percent since last month," and "The 1-percent increase marks the seventh-consecutive month of growth for home prices nationwide." That's every single state in the union. As you can see, since the second quarter of 2012, price appreciation has really taken off: That being said, prices now are only a bit higher than they were in the 2007 peak:  Federal Reserve Bank of St. Louis Federal Reserve Bank of St. Louis Still, that's a lot of growth without some sort of correction. I don't think the next dip will be anything like the last one. NINJA loans and teaser rates, are fortunately, a think of the past. But the Fed has had historically low rates for a very long time and the government is still pushing all sorts of low-money-down, affordable housing schemes.

The Fed, for its part, is likely to raise interest rates again this year, maybe more than once. And a new report shows that 40 percent of Americans couldn't come up with just $400 in emergency expenses. So we may be on the knife's edge. This is why I've been thinking the market would correct for almost two years now. That being said, there is actually a housing shortage in the United States right now. So perhaps the only thing that could really throw it for a loop is if the economy itself goes into recession and people can no longer afford to buy while others get foreclosed on after losing their jobs. The way things stand right now, I think that is the most likely scenario. Trump should probably stop bragging about the economy, because if you own the rise, you own the fall. And given we've had almost 10 years of uninterrupted growth, a recession is probably not too far away.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

November 2022

Blog Roll

The Real Estate Brothers The Good Stewards Bigger Pockets REI Club Meet Kevin Tim Ferris Joe Rogan Adam Carolla MAREI 1500 Days Worcester Investments Just Ask Ben Why Entrepreneur Inc. KC Source Link The Righteous Mind Star Slate Codex Mises Institute Tom Woods Michael Tracey Consulting by RPM The Scott Horton Show Swift Economics The Critical Drinker Red Letter Media Categories |

RSS Feed

RSS Feed