|

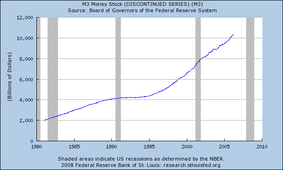

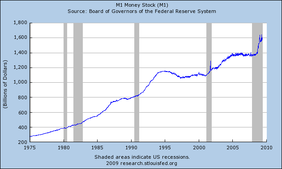

This is an old article on the 2008 financial crash that I wrote for Swifteconomics.com, which is now sadly defunct, that I would like to repost here. Hope you enjoy: In the first part of my series on the financial crisis, we discovered that by loosening regulations on the housing industry, while simultaneously continuing to federally back deposits and bailout banks in case anything went wrong, the government created an ample playground for massive speculation. In this second part, we will look at why that speculation was focused in real estate, and where the money to fund such speculation came from in the first place. We’ll start with the question: “Why housing?” It starts with a redefinition of the American Dream. Whereas in years past, the American dream was best defined as prosperity can be found in liberty, it has become, in modern times, that home ownership is the key ingredient to achieving such a dream. As George Bush’s Secretary of Housing and Urban Development, Alphonso Jackson put bluntly, “The American dream is to own a home.” This paradigm dates back to the New Deal. Before the New Deal, owning a home was not as important as it is today, because housing prices were relatively stable and even declined over the years. However, during the Great Depression, political radicalism became common place. In 1928, the Communist and Socialist parties garnered a combined 300,000 votes. In 1932, they received almost a million. (1) In an effort to stabilize the mortgage industry, and hedge off political radicalism, FDR and his brain trust decided to push for home ownership in the United States. They believed a property-owning citizenry would have a greater stake in the Republic and be less prone to revolutionary ideas. This culminated in the creation of Fannie Mae (and later Freddie Mac and Ginnie Mae). Fannie Mae works by buying mortgages directly from banks, thus freeing up capital for banks to make more home loans, thus creating more homeowners and fewer renters. And as a result, as economic historian Niall Ferguson puts it, the “property-owning democracy” was born. However, as nice as owning your home sounds, it is a poor, long term investment financially speaking, unless one has other assets with which to compliment it. In general, buying real estate to use as rental properties is a good investment. On the other hand though, piling a large percentage of one’s income into a home that provides no return outside of appreciation, puts all of one’s proverbial eggs in one proverbial basket. If the local housing market depreciates, a major portion of one’s wealth is affected. Every finance professor stresses the importance of diversification. The idea is to hedge the risk of certain companies and industries against as many other companies and industries as possible. By spreading one’s nest egg so thinly, if one company fails or a particular industry has a rough year, the overall portfolio is relatively unaffected. This is why most unseasoned investors put their money in mutual funds, 401K’s and IRA’s. These instruments are designed specifically to hedge clients against risk by investing in a large number of stable companies across a vast array of industries. This concept was, unfortunately, completely forgotten with regards to housing. And as the trumpeters for home ownership grew louder and louder, Fannie Mae, Freddie Mac and Ginnie Mae jumped on every opportunity they could to increase the availability of credit to homeowners. Their primary method was a process called securitization. In short, these government supported entities (GSE’s) could slice and dice a whole array of mortgages into mortgage backed securities and sell them off in little chunks to other investors (these investors are all over the world, which is one of the main reasons this crisis, which originated in the United States, is being felt worldwide). A few attempts were made to regulate Fannie Mae and Freddie Mac, but Congressional Democrats, lead by Barney Frank and Chris Dodd (who received more campaign funds from Fannie Mae than any other politician), would have none of it. As Democratic Congresswoman Maxine Waters, last seen on this blog trying to establish a Soviet Commissar to nationalize the entire oil industry, put it in a 2004 congressional hearing: “[We’ve been] through nearly a dozen hearings, where frankly, we were trying to fix something that wasn’t broke. Mr. Chairman, we do not have a crisis at Freddie Mac, and particularly at Fannie Mae, under the outstanding leadership of Mr. Frank Raines.” (2) Four years later the government had to nationalize both Freddie and Fannie. Good call Maxine. Regardless, as these GSE’s began slicing, dicing and selling mortgages off unimpeded, Wall Street decided to get their dirty hands in on the mess. With home prices rapidly increasing and an enormous influx of capital (to be discussed later), banks wanted to capitalize on this new financial instrument (the mortgage backed security). Fannie Mae and Freddie Mac started securitizing sub-prime and Alt-A mortgages in 1999, and major banks were particularly interested in going after this market as well. These borrowers usually had bad credit and little if anything to put down on a property. So Wall Street firms followed in Fannie Mae’s footsteps by piling large collections of these risky mortgages together and selling little pieces of them off to the general public. They thereby created a high yield investment vehicle that supposedly reduced risk by dividing the many mortgages up so thinly. Unfortunately, this only hedged against individual defaults or local downturns. It completely ignored the possibility that there was a systemic problem within the real estate market as a whole. In the words of Peter Schiff, who saw the crisis coming as early as 2002: “By creating a conflict of interest between the real estate market and mortgage market, securitization has corrupted an industry in which the availability and cost of credit are of central economic importance.” (3) Furthermore, the incredible complexity of these instruments made them almost impossible to value properly. To paraphrase Niall Ferguson, “instead of risk being transferred to those best able to bare it, risk was transferred to those least able to understand it.” Fannie, Freddie and Ginnie were not the only culprits, though. In the late 1990’s, the Clinton Administration put an extreme emphasis on increasing home ownership. Aside from giving the previously mentioned GSE’s more leeway, they also started vigorously enforcing everything they could find, or create, to increase home ownership. One of the most prominent was the Community Reinvestment Act, originally passed during the Carter Administration. The Community Reinvestment Act was originally passed with the intent to increase lending to minorities and end the discriminatory practice known as redlining (basically, banks wouldn’t lend to neighborhoods with large minority populations). Unfortunately, as these things often go, it went from one extreme to another, and the opposite of one crazy is still crazy. Instead of blacklisting minority applicants, in the 1990’s and 2000’s, banks were scared to death of lawsuits from declining mortgages to minorities or low-income folks, even if those particular people weren’t financially capable of meeting their mortgage obligations. Far left groups like ACORN were particularly active in finding cases of alleged discrimination that they could turn into extraordinarily expensive lawsuits. In one particular case, a bank was forced to make $2.1 billion dollars available to low income borrowers who would not have otherwise qualified. Andrew Cuomo, Bill Clinton’s Secretary of Housing and Development, even admitted, “…[it] will be a higher risk. And I’m sure there will be a higher default rate on those mortgages than on the rest of the portfolio.” (4) Wow, how compassionate of Mr. Cuomo. To paraphrase, in my own, sarcastic words, “We’re going to set poor people, who should be trying to save, up to fail by forcing other people to lend them money.” In the end, the common, “blame deregulation,” chants are rather ridiculous since just about every new policy enacted was to prop up housing, and almost explicitly NOT reign in the excesses throughout the industry. As economist, Tom Woods puts it: “We are supposed to place our hopes in regulators who would have to be courageous enough to stand up to against the entire political, academic and media establishments? What regulator would have done anything differently, or dared to tell the regime something other than what it obviously wanted to hear?” (5) So nearly every factor imaginable was pushing capital into the housing market. But where did all this money to put into real estate come from? Many haven’t even asked this question. The main reason, I believe, is that people do not properly understand real estate appreciation. Realtors and bankers often said during the run-up, “real estate prices always go up” and “think of your home as an investment.” In other words, think of a house like you would a stock. If the company becomes more profitable, the stock goes up in value. Real wealth has been created. No one will admit it, but the implied assumption was that when housing prices went up, wealth was being created. Somehow just about everyone, including myself, actually thought houses were becoming more “profitable” just by their mere existence. Houses do not become more “profitable” just by sitting there, though. They may become more valuable because of factors relating to supply and demand, but as houses get older and more worn down, they should actually depreciate. Real estate appreciation is accurately defined as anything that increases the value of a house. This could be adding an addition, remodeling the bathroom, putting in a swimming pool, etc. These types of activities add real wealth. When housing prices started to dart up around the turn of the century, no new wealth was being created. No, what we saw was nothing more than plain, old inflation. Inflation was thus misinterpreted as wealth, leading American consumers to borrow more and more, especially against their overvalued homes. Total mortgage debt in the United States is now around 12.5 trillion, up from $1.5 trillion in 1980! Total household debt was around 50% of GDP in 1980 and is over 100% today. (6) And the personal saving rate was around negative 1%, for most of the last decade. (7) Add this to the federal government’s enormous 10 trillion dollar debt and we discover that the United States was basically relying solely on debt to sustain its consumption; debt that could only be maintained through the equity American’s thought their homes had. U.S. citizens were literally refinancing their homes to buy consumer products. When those homes began to depreciate, the stage was set for a significant economic contraction. So where did this inflation come from? Well, it came from the extremely foolish policy of Alan Greenspan and the Federal Reserve. Tom Woods explains their missteps as follows: “The Fed… started the boom by increasing the money supply through the banking system with the aim and the effect of lowering interest rates in the wake of September 11, which came just over a year after the dot-com bust, then Fed chairman Alan Greenspan sought to re-ignitethe economy through a series of rate cuts, culminating in the extraordinary decision to lower the target federal funds rate (the rate at which banks lend to one another overnight, and which usually drives other interest rates) to 1 percent for a full year, from June 2003 until June 2004. In order to bring about this result, the supply of money was increased dramatically during those years, with more dollars being created between 2000 and 2007 than in the rest of the republic’s history.” (8) The Fed does not directly control interest rates or the supply of money, but through what are called open market operations, the Fed can have a substantial effect on these things. The most common method it uses is to buy up bonds with money it simply create out of thin air. This adds money into the economy which, through a process called fractional reserve banking, the Fed’s initial capital injection will increase 10 fold.* The Fed can also lower the discount rate (rate at which they loan directly to banks), or decrease bank’s reserve requirements to increase the money supply. Regardless of the methods the Fed used, what is clear is that the quantity of money rapidly increased throughout the ’90’s and into this decade. The Fed uses several indicators to track the total amount of money in the economy. One of these, known as M1, increased over 100% from 1990 to 2008. M3, a more accurate depiction of the money supply, which was discontinued in 2006 because of the difficulty measuring it, increased 150% from 1995 to 2005! (9) The Federal Reserve went way overboard in an attempt to stave off a severe recession in 2001. We still had one, but it was brief and mild. In essence, they delayed much of the pain we should have faced then until now. It should also be noted, that the 2001 recession was the only recession on record in which housing starts did not decline. This should have been a sure fire sign that something was amiss in the housing market. As Peter Schiff so fittingly put it, “George Bush, in one of his speeches, said that Wall Street got drunk… But what he doesn’t point out is where did they get the alcohol? Obviously, Greenspan poured the alcohol…” (10)

To summarize, the Federal Reserve dramatically lowered interest rates, thereby increasing the quantity of money in the economy. That money had to go somewhere and due to a host of government policies and political pressure, this money primarily found its way into housing. The dangerous combination of loosened regulation and the moral hazard of deposit insurance, as well as an implicit bailout guarantee, made banks feel more and more comfortable making loans to less and less credit-worthy borrowers. With securitization, Fannie Mae, other GSE’s and banks were able to sell off their overvalued debt to unsuspecting investors, thereby infecting the entire economy. When adjustable rate mortgages began adjusting, the least credit-worthy borrowers began defaulting on their mortgages, causing home prices to fall. As home prices fell, homeowners lost their equity and could no longer refinance, thereby causing more foreclosures. As foreclosures spiked, investors and banks holding these mortgage backed securities, as well as insurance companies such as AIG who backed them, began taking massive losses. Massive losses on Wall Street meant firms had to lay-off workers. And without the ability to refinance, homeowners had less money to spend causing firms outside of finance to become less profitable and either go out of business or downsize. Thus, a mortgage meltdown turned into a financial crisis and culminated in a severe recession. Hopefully, we’ll learn the right lessons from the whole mess. Unfortunately, I kinda doubt it. _______________________________________________________________________________ *Fractional reserve banking is when a bank only has to keep a certain percentage of their deposits on hand and can loan out the rest. Typically, banks only have to keep 10% of deposits on hand and can lend out the other 90%. That 90% is then deposited in another bank, which loans out 90% of the original 90% and so on. Eventually, assuming a 10% reserve requirement, the initial deposit will increase by a multiple of 10. Mathematically it looks like this: X = Initial Deposit Y = Reserve Requirement X/Y = Total Amount of money added to the economy So for example, if you deposit $100 at a bank that has a 10% reserve requirement: $100/0.1 = $1000 will be the total amount of money eventually created. _________________________________________________________________________________ (1) “United States presidential election 1928” and “United States presidential elcction 1932,” Wikipeda.org, http://en.wikipedia.org/wiki/United_States_presidential_election,_1928and http://en.wikipedia.org/wiki/United_States_presidential_election,_1932 (2) “Shocking Video Unearthed Democrats in their own words Covering up the Fannie Mae, Freddie Mac Scam that caused our Economic Crisis,” Retrieved May 31, 2008, http://www.youtube.com/watch?v=_MGT_cSi7Rs (3) Peter Schiff, Crash Proof, Pg. 126, John Wiley & Sons, Inc., Copyright 2007 (4) “EVIDENCE FOUND!!! Clinton administration’s “BANK AFFIRMATIVE ACTION” They forced banks to make BAD LOANS and ACORN and OBama’s tie to all of it!!!,” Retrieved May 31, 2008, http://www.youtube.com/watch?v=ivmL-lXNy64 (5) Thomas Woods, Meltdown, Pg. 29, Regnery Publishing, Inc., Copyright 2009 (6) “Consumer Debt Outstanding” and “Household Debt% of GDP,” PrudentBear.com, both uploaded 2/28/2009, http://www.prudentbear.com/index.php/consumer-debt and http://www.prudentbear.com/index.php/household-sector-debt-of-gdp (7) “Our Savings Rate Is (Still) Negative: Should We Worry,” My Money Blog, 2/4/07, http://www.mymoneyblog.com/archives/2007/02/our-savings-rate-is-negative-should-we-worry.html (8) Thomas Woods, Meltdown, Pg. 26, Regnery Publishing, Inc., Copyright 2009 (9) “Series: M1, M1 Money Stock” and “Series: M3, M3 Money Stock (DISCONTINUED SERIES),” Federal Reserve Bank of St. Louis, http://research.stlouisfed.org/fred2/series/M1 and http://research.stlouisfed.org/fred2/series/M3 (10) Peter Schiff, “Why the Meltdown Should Have Surprised No One,” The 2009 Henry Hazlitt Memorial Lecture, Retrieved May 31, 2008, http://www.youtube.com/watch?v=EgMclXX5msc

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

November 2022

Blog Roll

The Real Estate Brothers The Good Stewards Bigger Pockets REI Club Meet Kevin Tim Ferris Joe Rogan Adam Carolla MAREI 1500 Days Worcester Investments Just Ask Ben Why Entrepreneur Inc. KC Source Link The Righteous Mind Star Slate Codex Mises Institute Tom Woods Michael Tracey Consulting by RPM The Scott Horton Show Swift Economics The Critical Drinker Red Letter Media Categories |

RSS Feed

RSS Feed