|

Here is one of my better articles I wrote for my previous blog Swifteconomics some time back that I thought I would repost:

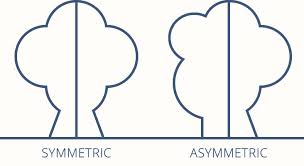

Consider the following scenario: you are hanging out with two friends and telling a really funny story about something you did a while back. One of the friends participated in this adventure, the other did not. Just before you reach the crescendo in your story, the friend who endured this event with you interjects with an inside joke about this humorous episode. Unfortunately, since the story has yet to be completed, this leaves the other friend completely bewildered. Suddenly, the story’s momentum has been obliterated. The build-up has been interrupted. The setting, distorted. The foreshadowing, forgotten. The dramatic irony, melodramatized. And the protagonists and antagonists mixed up into an indecipherable mess of nameless, meaningless, literary characters moving across a vague landscape of disinterested, academic discussion; bringing back traumatic memories of AP Lit in high school. Memories you had previously hoped to have finally blocked out, sending them into the empty recesses of the dark corners of your mind. Alas, you have now realized it was to no avail, because said memories have returned, en masse, with a particularly scornful vengeance. And regrettably, no matter how hard you try to brush off the comment, you must delay your epic narrative to explain this inside joke, before getting back to chronicling your grand tale. Then, by the time the story finally reaches its forte, all that’s left is a modest giggle, instead of what should have been an all out belly laugh. This highlights an asymmetry of information; the inside joke was funny. It really was. But that means nothing, since the third person did not understand the situation at hand. And now for my truly inspiring, non-non sequitur of a segue: this type of thing happens in the marketplace all the time. In Steven D. Levitt and Stephen J. Dubner’s popular book Freakonomics, they discuss this very thing, when describing the similarities between Realtors and the Ku Klux Klan. That isn’t to say that Realtors are all a bunch of uber-racists, who get their jollies by dressing up as the Conehead’s version of Casper the Friendly Ghost. What they describe is how both groups, the Realtors and the Klu Klux Klan alike, rely on an asymmetry of information to maintain their place in the market; the market for housing, in the Realtor’s case, and the market for disgruntled, racist, rednecks with nothing better to do, in the Klan’s case. As Levitt and Dubner put it: “Information is a beacon, a cudgel, an olive branch, a deterrent, depending on who wields it and how. Information is so powerful that the assumption of information, even if the information does not actually exist, can have a sobering effect.” (1) The Klu Klux Klan has changed a lot over the years, but its later stages fit into this discussion very well. By the 1940’s, the Klan wasn’t particularly violent, instead it was: “…a sorry fraternity of men, most of them poorly educated and with poor prospects, who needed a place to vent – and an excuse for occasionally staying out all night. That their fraternity engaged in quasi-religious chanting and oath taking and hosanna hailing, all of it top secret, made it that much more appealing.” (2) A man named Stetson Kennedy made it his mission to discredit the Klan, and bigotry in general, and therefore decided to join and uncover its secrets. Once he accomplished this, he broadcasted those “secrets” on the radio for all to hear and “it had the precise effect he hoped: turning the Klan’s secrecy against itself, converting precious knowledge into ammunition for mockery.” (3) The asymmetries of information were what had made the Klan interesting (well, interesting to disgruntled, racist, rednecks with nothing better to do, at least). After this information became symmetrical, the Klan became what it deserved to be: a joke. As for the Realtors, they have what economists call the principle-agent problem. Namely, that they know much more about the market than you do, or at least pretend to (that talk about real estate always going up back around 2006, has surprisingly, put a bit of a chink in their credibility), so they can convince you to agree to price your home as they see fit. And unfortunately, the incentives for you and your agent, likely differ. Theirs is to get the property sold as quickly as possible; yours is to get the best price. But with the aforementioned asymmetry of information, “…you fear setting the price too low… [or] setting the price too high. It is the job of your real-estate-agent, of course, to find the golden mean.” (4) Too bad your incentives don’t align and the information is so asymmetrical. “…[A] study found that an agent keeps her own house on the market an average ten extra days, waiting for a better offer, and sells it for 3 percent more than your house.” Thus giving your Realtor “a nifty profit produced by the abuse of information and a keen understanding of incentives.” (5) The Internet has certainly helped to curtail these excesses, as consumers can use the World Wide Web for not only its primary purposes (buying useless crap on eBay, collecting an assortment of malware, and of course, pornography), but also to obtain valuable information about the benefits, and shortcomings, of various products. The Internet does have its downsides, though, as there is almost too much information which can become a bit overwhelming. In addition, unscrupulous, pimplely-faced, teenage web geeks, eating cheese puffs in their mother’s basement, can now use a host of fancy programming techniques to dupe people into buying neuro-homeopathic, weight loss defibrillators and the like. OMG, I mean IMHO the thought of those PPL ROFL after one of their scams is just like WTF you know! At least you can occasionally get lucky and receive an offer for $100,000 from an exiled Nigerian Prince, as long as you deposit a couple hundred dollars in a Swiss bank account, providing his brother the means to grant him asylum in Belarus. Regardless, shysters can still get their unfair share of the loot. Internet or not, asymmetries are here to stay. How society should deal with this is a complicated issue. Many believe regulation is required, and some would not be a bad idea. However, we should be very cautious with this approach. Many people seem to believe that the government often operates to please large interest groups, usually major corporations. It should, therefore, be no surprise that the regulations governments enact often serve this purpose. Yet, these same people also tend to believe the government should do more to rein these groups in. If this could realistically be done, it would certainly be a good thing. However, it is asking quite a lot of our super-principled, morally guided, borderline infallible politicians. In the end, it shouldn’t surprise anyone that the government will prostitute itself out to the highest bidder, which just happens to usually be large interest groups. The other option would be to dismantle these groups (such as the National Association of Realtors) or reduce their power to cartelize markets. As Milton Friedman wrote, “…a producer group tends to be more concentrated politically than a consumer group.” (6) Therefore, it would be wise to eliminate these groups, or at least curtail their authority. This would be the radical, free market approach, whose supporters, many believe, see the market economy as a perfect system, where everyone would succeed and we would be so prosperous that the poor would be riding around in stretch limos (and the rich in stretch, space ship limos), if we could just got the government out of the way. No, this approach would certainly leave some vulnerable to snake oil salesmen. But on the whole, it may be a better way to reduce such asymmetries by opening these groups up to more competition. Both regulation and deregulation have disadvantages but in some ways, the radical free market approach may be the more steely-eyed, realist approach. Regardless of political decisions, the best way to deal with information asymmetries individually is to simply know they exist. So next time you want to list a house for sale, do some research on the market yourself before signing your fate away, and get several Realtor’s opinions before settling on a broker. And if a friend is ever telling an awesome story in mixed company, and you have an even more awesome inside joke you’re dying to tell, do your friend a favor and bite your tongue for the time being. ___________________________________________________________________________________ (1) Steven D. Levitt and Stephen J. Dubner, Freakonomics, Pg. 67, HarperCollins Publishers Inc.,Copyright 2005 (2) Ibid., pg. 62 (3) Ibid., pg. 65 (4) Ibid., pg. 71 (5) Ibid., pg. 72 (6) Milton Friedman, Capitalism and Freedom, Pg. 143, University of Chicago Press, Copyright 1962

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

November 2022

Blog Roll

The Real Estate Brothers The Good Stewards Bigger Pockets REI Club Meet Kevin Tim Ferris Joe Rogan Adam Carolla MAREI 1500 Days Worcester Investments Just Ask Ben Why Entrepreneur Inc. KC Source Link The Righteous Mind Star Slate Codex Mises Institute Tom Woods Michael Tracey Consulting by RPM The Scott Horton Show Swift Economics The Critical Drinker Red Letter Media Categories |

RSS Feed

RSS Feed