|

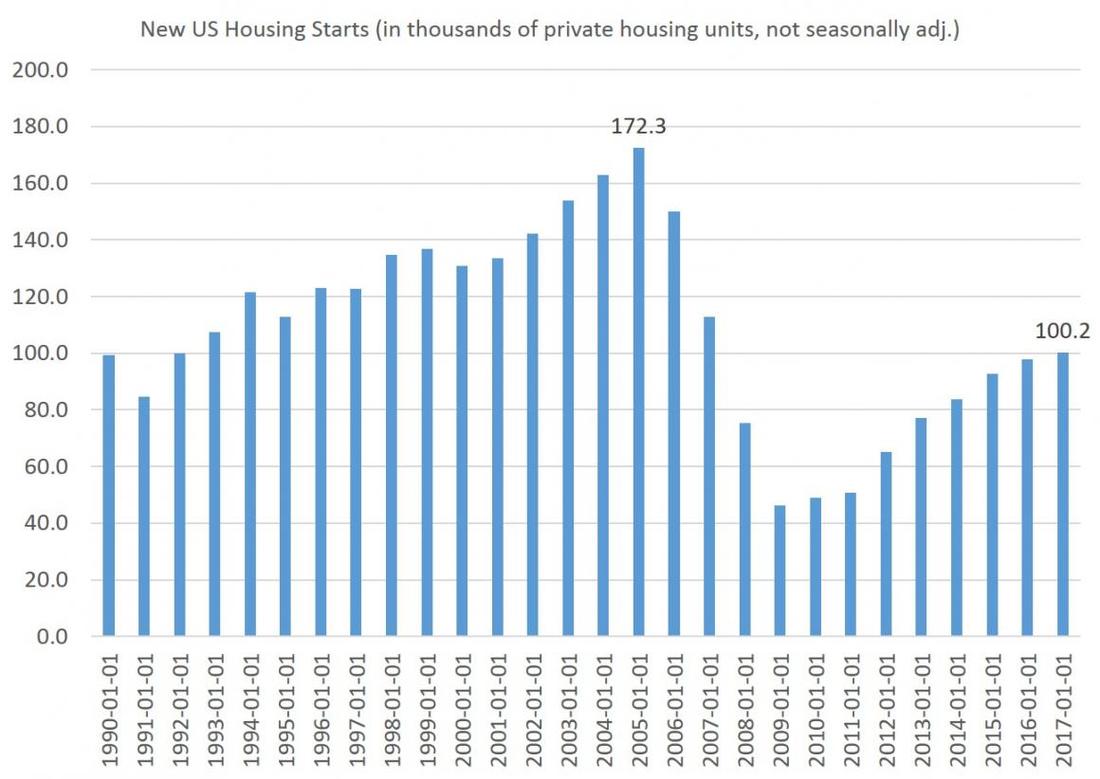

Over at Mises.org (a site I have written a lot for, by the way), Ryan McMaken has made a good case that we are not facing another major housing bubble, even though in many ways, it feels like it did in 2007-2008 during the last run up. "On the most superficial level, the current boom might remind some of the pre-2008 bubble. Housing prices are climbing fast, and in many areas, there are bidding wars for houses that are quite ordinary. "This time, though, things are different. This time, there isn't nearly as much housing being built was during the last bubble. There may be a bubble in prices this time, but there does not appear to be a bubble in construction. "A look at housing starts in recent years shows that in raw numbers, starts are still not even close to getting back to where they were during the last boom:" He then produces this chart, And further McMaken notes, "As both the Wall Street Journal and USA Today noticed last month, the amount of new housing construction taking place right now, as a proportion of existing households, is at historic lows."

Yes, housing will likely go down in price if we enter a general recession. But, with there still existing a national housing shortage, if real estate goes down, it will be following the economy not leading it. In all likelihood, prices will continue to rise for the time being.

Comments

|

Andrew Syrios"Every day is a new life to the wise man." Archives

November 2022

Blog Roll

The Real Estate Brothers The Good Stewards Bigger Pockets REI Club Meet Kevin Tim Ferris Joe Rogan Adam Carolla MAREI 1500 Days Worcester Investments Just Ask Ben Why Entrepreneur Inc. KC Source Link The Righteous Mind Star Slate Codex Mises Institute Tom Woods Michael Tracey Consulting by RPM The Scott Horton Show Swift Economics The Critical Drinker Red Letter Media Categories |

RSS Feed

RSS Feed